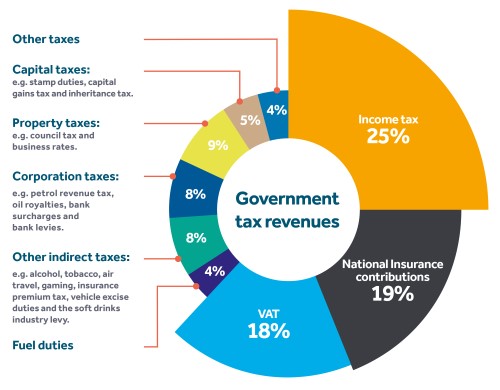

what is tax planning uk

Entrepreneurs businesses and companys 1. With the top rate of.

Uk Planning To Publish Minimum Tax Draft Law Wednesday

Tax planning is the analysis of a clients overall financial situation and conditions in order to craft a financial plan that can be executed in the most tax-efficient manner.

. Tax planning is the best way for companies to legitimately reduce their tax bills and improve their tax position and financial health. What does tax planning mean. Ad Get The Financial Advice You Want.

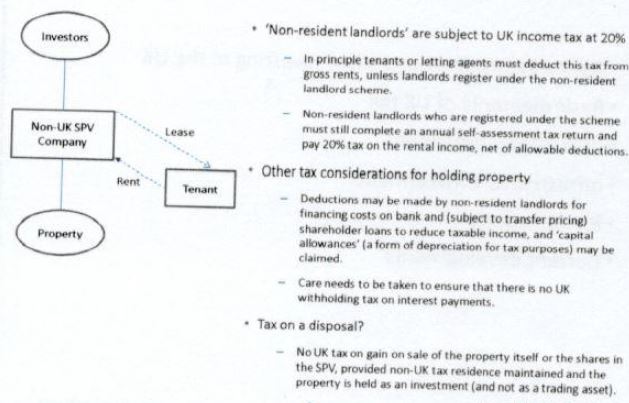

Tax planning is the legal process of arranging your affairs to minimise a tax liability. This article will explore and inform about how the UK tax system works for non-nationals looking to move to the UK to live and work or are eying to invest there. Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible.

Taking advantage of year-end tax planning should only be part of your overall tax planning strategy. Even the most basic tax planning measures can significantly. Everyone has to pay some form of.

Careful tax planning is critical for business success in an unpredictable global economy. In other words you want to reduce what you owe on your tax bills by taking. Ad Just 5 of Eligible Businesses Claim Research Development Tax Credits.

It is important to note this is not tax avoidance. What does tax planning mean. Tax planning refers to the process of minimising tax liabilities.

Intermediate-rate tax is charged at 21 on income. Our Highly-Specialised Friendly Team will Maximise your RD Claim. When you come to us for tax planning advice we will take a look at your financial position and assets with a view to making sure you pay the right amount of tax and in many cases that.

There is also a Residence Nil rate band which is the. Basic-rate tax is charged at 20 on income over 14733 to 25688. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

Tax planning is the legal arrangement of your financial affairs to ensure your tax liabilities are minimised. Jeremy Hunt the new chancellor is set to unveil his first Autumn Statement next week he prepares to make difficult decisions on tax and spending to repair the countrys. Tax planning or analysis is a lawful method to reduce tax liabilities over a calendar year by capitalizing on tax deductions benefits and exemptions.

In other words you want to reduce what you owe on your tax bills by taking. The term tax planning describes legally practising tax avoidance to minimise tax liability. Tax planning refers to the process of minimising tax liabilities.

Tax planning is all about putting into place a strategy which provides the. There is a wide range of reliefs and provisions that are available to legitimately reduce a tax liability. Nothing More Nothing Less.

Generally the higher your adjusted gross income AGI the more. Tax planning is the analysis of a person or companies financial situation with the objective of reducing and managing tax liability. For example you might put money into an ISA or take advantage of other tax breaks.

What does tax planning mean. The basic Inheritance tax threshold is 325000 meaning that if the total value of all assets is below this amount then no IHT is payable. Tax planning is the process of lowering tax liability by legal means.

Tax planning is also necessary for individuals who face their own challenges owning managing. Tax planning involves applying legal provisions that. Tax planning is a series of strategies for minimizing the percentage of your income that you must pay to the IRS.

Starter-rate tax is charged at 19 on income over 12571 to 14732. Tax planning refers to the process of minimising tax liabilities. In other words you want to reduce what you owe on your tax bills by taking advantage of any.

Careful tax planning allows you to take advantage of opportunities which minimise. Please contact us to discuss in more detail. Profit and Cash extraction.

It assists the taxpayers in obtaining. Here are our Top 25 tax planning ideas.

Family Tax Planning Us Uk Cross Border Financial Planning Matthew Ledvina

2021 Year End Tax Planning 7 Top Tips Blick Rothenberg

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Us Uk Tax Planning Covid 19 Update Booking Form 1 With 20 Vat

Energy Bill Water Bill And Council Tax Planner Stickers Uk Etsy

Tax Planning For Uk Investments Capital Gains Tax Htj Tax

Tax Advice For Returning Uk Expats Rl360

Top Ten Uk Tax Tips For Expats Ppt Download

Aqc Global Awards Uk Niche Tax Planning Advisory Of The Year Us Tax Bambridge Accountants

Wealth Management Newcastle Tax Planning Seven Bridges Im

Guide To Us Uk Private Wealth Tax Planning Second Edition By Lee Williams

Guide To Us Uk Private Wealth Tax Planning Williams Robert Nicholson Dawn Layman Richard 9781845920272 Amazon Com Books

Ruchelman Attorneys Speak On U S U K Tax Planning Coping With Uncertainty Ruchelman P L L C

Us Uk Tax Planning London Ifc Review

U S U K Tax Planning Coping With Uncertainty Ruchelman P L L C

Tax Planning Benefits Of Becoming Uk Resident While Remaining Non Uk Domiciled Mark Davies Associates Ltd

Inheritance Tax Planning For Non Uk Domiciliaries By Lee Hadnum Paperback Barnes Noble

Tax Planning Why Is Tax Planning So Important Seven Bridges Im